Industry spotlight – 8 things you might not know about FinTech in Ireland

Many countries and companies are eyeing up Ireland’s flourishing Fintech Industry. We have some of the most innovative FinTech founders, we have attracted well-established multinationals, and we are also a hub for scrappy start-ups.

However there’s lots to learn about the evolving industry, here are 8 things you may not know about FinTech here in Ireland.

1. The Irish FinTech ecosystem

The Irish Fintech ecosystem comprises of every area of technology and innovation in the financial services arena, from payments, trading and FX, big data, risk, compliance and business intelligence to consumer-focused currency exchanges and peer to peer lenders.

2. Small FinTech companies raising records

Small FinTech companies raised more than €101 million in the first three quarters of 2016. This is up more than 50% from the full-year 2015 figure. You can read more here thanks to the Irish Venture Capital Association.

3. The Fintech and Payments Association of Ireland

The Fintech and Payments Association of Ireland (FPAI) is an organisation established to further the interests of the stakeholders in the Irish FinTech ecosystem. Find out more about the FPAI and membership here.

4. Demand for FinTech roles has increased by 90%

In 2016, searches for jobs in fintech increased by 85% worldwide, a trend reflected in the Irish market with an increase of 90% in the past six months. While on the employer side, Ireland ranks second in demand for cyber security professionals, as measured by open roles versus searches, with Israel top of the list and the UK in third.

5. FinTech’s fancy cousins RegTech and InsurTech

RegTech is shorthand for regulatory technologies — web platforms or algorithms designed to streamline processes of regulatory compliance, risk management and reporting. While not all RegTech is financial, a large chunk of it is, driven by the need for small financial firms to navigate the complex government regulations that big corporations once handled in-house. InsurTech, you guessed it, stands for insurance technologies. Apps, softwares, and startups are reinventing the insurance industry.

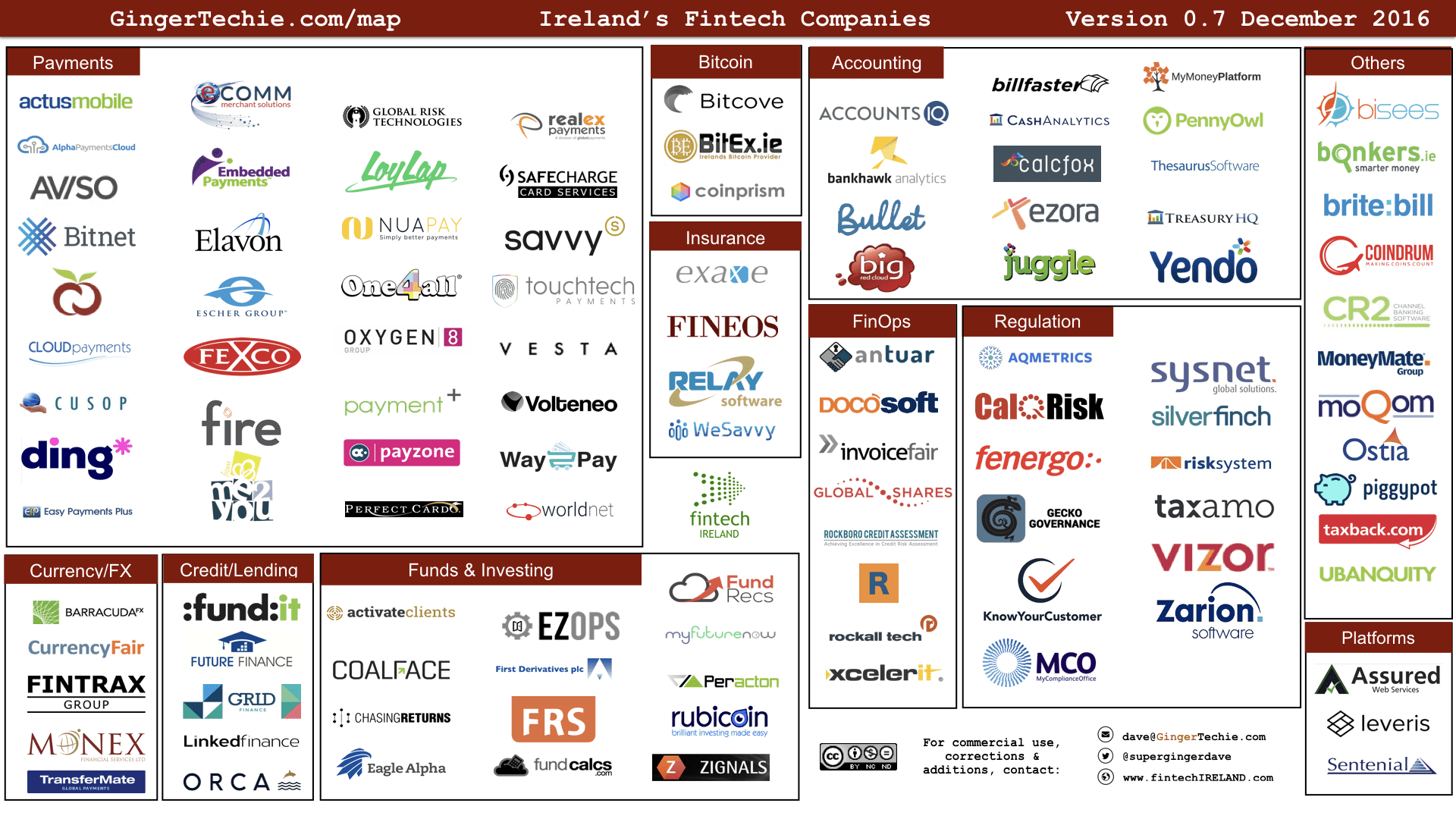

6. FinTech in Ireland mapped out

FinTech in Ireland is constantly changing and evolving, the latest analysis of the industry was carried out in December 2016 by Dave Anderson for Fintech Ireland. You can see the sector divided up between payments, currency/FX, lending, investing, bitcoin, insurance, accounting, regulation, FinOps, platforms and others.

7. Start-up stats

IFS Ireland, the banner brand for Ireland’s international financial services industry, has a dedicated section on their website to FinTech Futures, and it is fascinating. According to the site, start-up activity in IFS hit an all-time high in 2015 with activity doubling from 2014 to 2015. Three Fintech accelerators, NDRC, Mastercard and Accenture Fintech labs, are contributing to the increase in start-ups. Included in Ireland’s 2016 IFS2020 actions is a commitment by Enterprise Ireland, with support from the FPAI, was to launch a CSF (Competitive Start Fund) for start-ups, which resulted in equity investment support of €50,000 for 10 start-ups.

8. FinTech Industry Spotlight

The website fintechscene.ie has analysed the industry in Ireland, and created some super helpful graphics. In these you can view by business type, size and stage. Some interesting facts are that 21% of the Fintech industry in Ireland is made up of payments companies, while 12% are advisory companies. 24% of FinTech companies employ 1,000-10,000 people.